Market volatility is “the frequency and magnitude of price movements, up or down. The bigger and more frequent the price swings, the more volatile the market is said to be” (Ashford, Forbes Advisor). When a drop in the market occurs, it’s easy to get discouraged or nervous about your retirement savings – but don’t panic!

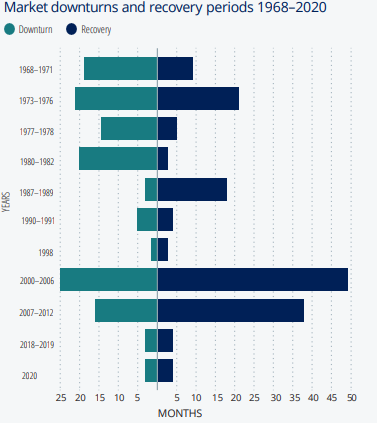

Market volatility is a normal part of the stock market cycle and should be considered in long-term investment strategies. Staying committed to your strategy during volatile periods can help achieve retirement goals. Understanding stock market history, which includes recoveries after drops, can provide peace of mind. Remember: Past performance is not a guarantee of future results.

How can I Best Manage Risk?

When planning your investment strategy for retirement, consider your risk tolerance based on factors like your age, retirement timeline, and current savings. If you have a long time before retirement, an aggressive portfolio with high growth potential but more volatility might be suitable. If you’re close to retirement, a conservative portfolio can protect against short-term fluctuations. Additionally, diversifying your portfolio across different asset classes and market segments can help mitigate the impact of market volatility, providing a more stable overall performance.

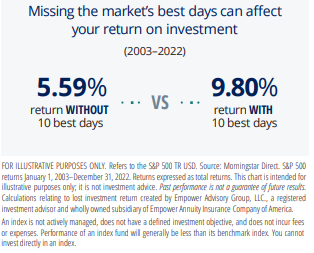

Don’t Try Timing the Market

It’s tempting to try, but taking your money out of the market in order avoid the worst days could end up setting you back. The market’s unpredictable nature means it might improve drastically on any given day, and missing out on the best days may result in significant losses compared to simply riding out the market volatility.

If you have questions, you can reach out to Empower directly at (800) 338-4015 or Melanie Gibson, our 401k and ESOP Administrator at mgibson@cmacars.com.

Leave a Reply

You must be logged in to post a comment.