Health savings accounts (HSAs) are tax-advantaged savings accounts that allow you to set aside pre-tax money to pay for qualified medical, dental, and vision expenses.

Health savings accounts (HSAs) are tax-advantaged savings accounts that allow you to set aside pre-tax money to pay for qualified medical, dental, and vision expenses.

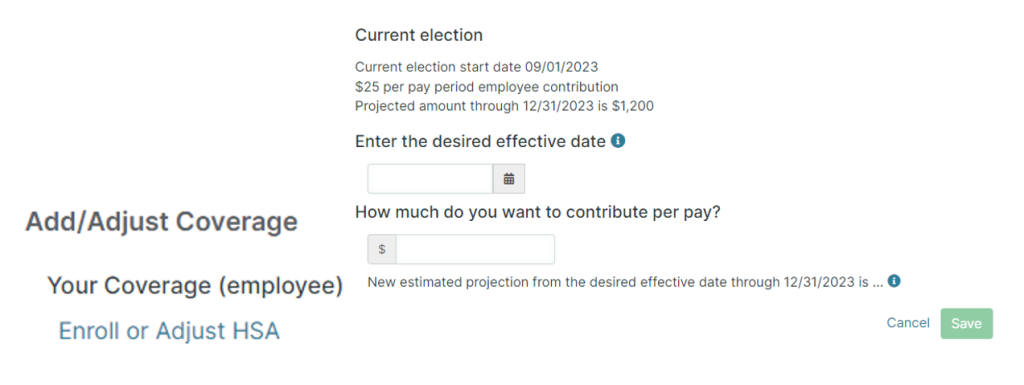

If you are enrolled in a high-deductible health plan (HDHP), you are eligible to contribute to an HSA. You can adjust your HSA contributions anytime through Employee Navigator. Log in from the link along the left hand of your Paylocity homepage.

Once in the Employee Navigator site:

Click LIFE EVENTS > Scroll to the bottom and Click ENROLL OR ADJUST HSA > There is some information about HSA accounts and the IRS and at the bottom two fields where you can enter a new contribution and the effective date.

HSAs offer a number of benefits, including:

- Tax savings: Contributions to HSAs are tax-deductible, reducing your taxable income. Earnings on your HSA investments grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

- Flexibility: You can use HSA funds to pay for a wide range of qualified medical expenses, including deductibles, copays, coinsurance, prescription drugs, and over-the-counter medications. You can also use HSA funds to pay for certain dental and vision expenses.

- Portability: HSAs are portable, meaning that you can keep your HSA even if you change jobs or health plans.

- Savings for retirement: After age 65, you can use HSA funds to pay for any expense, not just medical expenses. This makes HSAs a valuable tool for saving for retirement.

Leave a Reply

You must be logged in to post a comment.